Syracuse University

Present Value 1: Fundamentals

Here are the key equations for doing present value calculations.

A single payment

The present value of a single payment of F dollars in year T when the interest rate is r is given by the formula:

PV = F/(1+r)T

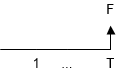

The cash flow diagram that corresponds to this case is:

A series of payments

The present value of a series of payments is just the sum of the present values of the individual payments. For example, the PV of a sequence of payments of F1 dollars in year 1, F2 dollars in year 2, zero dollars in year 3 and F4 dollars in year 4 would be:

PV = F1/(1+r) + F2/(1+r)2 + F4/(1+r)4

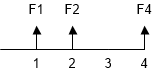

The cash flow diagram that corresponds to this case is:

An infinite series of payments

The present value of receiving F dollars per year forever starting one year from now is:

PV = F/r

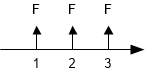

The cash flow diagram that corresponds to this case is:

An easy way to remember the formula is to turn it around this way:

F= r * PV

This says that you would need to put PV dollars in the bank at interest rate r in order to earn F dollars in interest each year forever.

Net present value

If the stream of payments involves costs as well as benefits then the present value is the sum of the present values of the individual payments treating the costs as negative payments. This is called "net present value". It can be calculated in two equivalent ways. One approach is to compute the present value of the benefits minus the present value of the costs:

NPV = PV(B) - PV(C)

The other approach is to subtract each year's costs from that year's benefits and take the present value of the stream of net payments:

NPV = PV(B-C)

These give identical results and you can use whichever one is most convenient for the particular problem at hand.

Additional Resources

- Exercises

- Problems involving present value calculations, with solutions.

- Present Value 2: Combined Forms

- Some extensions built from the fundamentals above.

URL: https://cleanenergyfutures.insightworks.com/pages/127.html

Peter J Wilcoxen, The Maxwell School, Syracuse University

Revised 08/17/2016